Popular News

Loan limit under Kamyab Jawan Programme increased by five times

Loan limit under Kamyab Jawan Programme increased by five times on the International Youth Day on Wednesday.

Adviser to Prime Minister on Finance and Revenue Dr Abdul Hafeez Shaikh has announced five-fold increase in the loan limit under the Kamyab Jawan Programme.

Loan limit under Kamyab Jawan Programme increased by five times

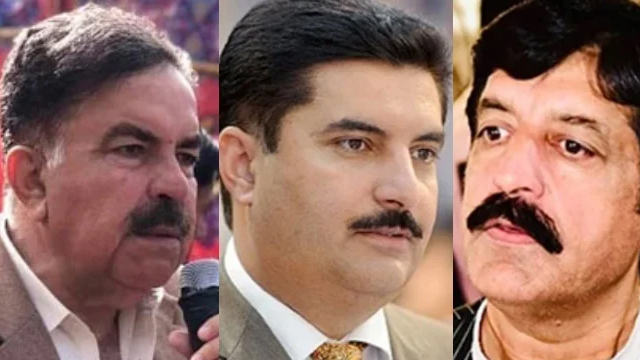

He said this while addressing a press conference. Special Adviser to the Prime Minister on Youth Affairs Usman Dar accompanied him.

Sheikh also announced halving the markup rate on the loans provided through the programme.

The loan limit had been increased from Rs 5 million to Rs 25 million, with markup rates cut to half from 6 percent to 3 percent and from 8 percent to 4 percent, he added.

He said the markup rate on the loans already provided to the people would also be halved.

The advisor said the number of banks through which the loans would be provided under the programme had been increased from three to 21 with an aim to facilitate the people, help jobs creation and promote economic growth.

Prime Minister Imran Khan’s vision

He said the Kamyab Jawan Programme launched as per Prime Minister Imran Khan’s vision to facilitate the common people.

It aims to provide them an opportunity to have access to the soft loans to run their own businesses.

The Finance Ministry would provide all the required funds necessary for the programme

Talking about the performance of economy, Hafeez Sheikh said the economic indicators had been showing positive development, citing 6 percent increase in exports that were recorded around $2 billion in July 2020.

The revenue collection during the first month of current fiscal year, he said, was also recorded at Rs 300 billion, which was 23 percent more than the collection of the same month of last year.

He said the economic activity in the country had accelerated with 22 percent increase in the consumption of cement and 6 to 10 percent raise in the use of petrol and diesel, while the automobiles’ sale had also increased in the month.

There was need to carry forward the trend and the government was taking all possible measures to generate economic activity, he added.

Performance of Pakistan Stock Exchange

The advisor said the confidence of both international and domestic investors was increasing in Pakistan as was evident from the performance of Pakistan Stock Exchange, which was declared the second largest market in terms of growth by the Bloomberg.

Moreover, the Moody’s had also provided a stable rating for Pakistan’s economy, which was an encouraging sign for the country, he added.

The advisor said the budget for the fiscal year 2020-21 was based on the philosophy to facilitate people and businesses. He said no new taxes were introduced to promote business, duties were reduced while the government cut its expenditures.

He said no supplementary grants were provided to any ministry, division or the department during the last fiscal year The advisor said the government provided the corona relief package of Rs 1,200 billion to ensure cash payment to the people in a transparent manner without any discrimination and irrespective of political affiliation and region. “There was just one requirement and that the person should be a Pakistani national.”

He said the people, small and medium enterprises, and the export sector industries were facilitated though various incentives packages on utility bills to mitigate the corona effects on them.

The aim was to steer them out of the crisis situation created due to the outbreak of coronavirus and consequent lockdown, he added.