Fitch raises Pakistan credit rating to B- after economic improvements

Fitch Pakistan credit rating

Islamabad – In a major boost to investor confidence, Fitch Ratings on Monday upgraded Pakistan’s long-term foreign-currency issuer default rating from ‘CCC+’ to ‘B-’, citing improved fiscal consolidation, a stabilising external account, and stronger macroeconomic policy management. The outlook remains stable.

The upgrade reflects renewed confidence in Pakistan’s ability to maintain tighter budget controls and implement structural reforms under its current program with the International Monetary Fund (IMF).

Key Drivers Behind the Upgrade

Fitch said, “We expect tight economic policies to continue supporting the recovery of international reserves and contain external funding needs,” while also cautioning that Pakistan still faces high financing requirements and risks in policy execution.

The move follows Islamabad’s recent progress, including:

Agreement with the IMF on the review of a $7 billion Extended Fund Facility (EFF)

Launch of a new $1.3 billion Resilience and Sustainability Facility (RSF)

Finance Minister Welcomes Upgrade

Finance Minister Senator Muhammad Aurangzeb welcomed the development, calling it “a strong vote of confidence in Pakistan’s economic reforms and policies.” He added, “This will further strengthen the government’s economic agenda and open doors to more investment, trade, and employment.”

Macroeconomic Improvements Highlighted by Fitch

Budget Deficit: Expected to narrow to 6% of GDP in FY25 from nearly 7% last year

Primary Surplus: Forecast to exceed 2% of GDP, more than double previous levels

Public Debt: Declined to 67% of GDP in FY24, down from 75%

Inflation: Projected to ease to 5% in FY25, down from over 20% in recent years

Foreign Exchange Reserves: Reached $18 billion in March 2025, up from under $8 billion in early 2023

GDP Growth: Expected to rebound to 3% in FY25

The State Bank of Pakistan (SBP) has kept its policy rate at 12%, maintaining stability after a year of aggressive monetary easing.

External & Political Outlook

Pakistan recorded a $700 million current account surplus in the first eight months of FY25, supported by rising remittances and lower import prices. However, external debt maturities remain a challenge, with $8 billion due this year and $9 billion in FY26.

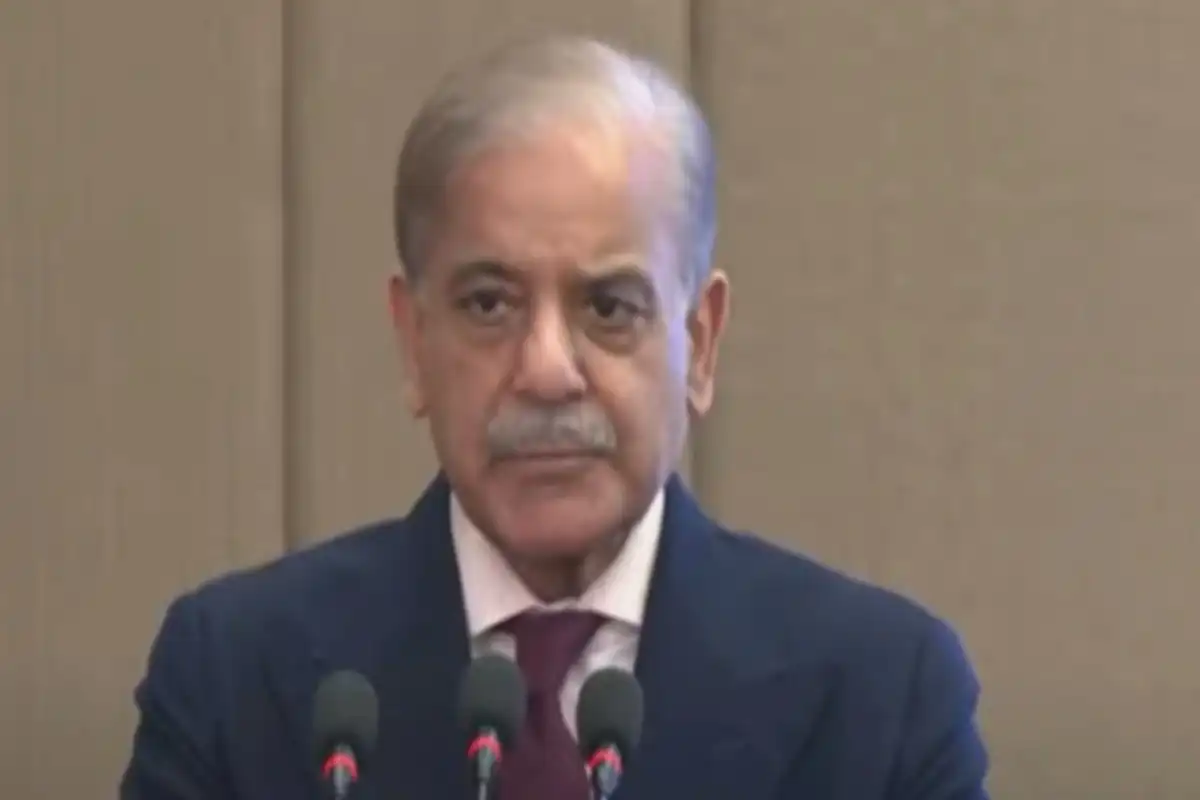

Fitch noted that the political landscape remains uncertain, with Prime Minister Shehbaz Sharif’s coalition government holding a parliamentary majority but facing public dissatisfaction, security concerns, and institutional instability.

The rating committee acknowledged that while Pakistan’s model score aligns with ‘CCC+’, a one-notch upgrade was applied due to improvements in macroeconomic management and inflation control.

Catch all the Pakistan News, Breaking News Event and Trending News Updates on GTV News

Join Our Whatsapp Channel GTV Whatsapp Official Channel to get the Daily News Update & Follow us on Google News.