The government is contemplating imposing a sales tax on petroleum products and raising the petroleum levy in the upcoming fiscal year 2025–26.

According to the sources, petroleum products are exempt from sales tax, but a proposal is under review to introduce a sales tax ranging from 3% to 5%. Alongside this, the petroleum levy is proposed to increase to between Rs 90 and Rs 100 per litre. Presently, the levy stands at Rs 78.02 per litre for petrol and Rs 77.01 per litre for high-speed diesel.

These tax measures will only be finalized after formal approval through the Finance Bill by the federal cabinet.

Under International Monetary Fund (IMF) conditions, the petroleum levy collection target for the next fiscal year is set at Rs 1,311 billion, which is Rs 194 billion higher than the current fiscal year. From July 2024 to March 2025, collections amounted to Rs 833.84 billion.

Officials caution that these tax changes will likely prevent any reductions in international fuel prices from benefiting the public.

On April 16, 2025, the federal government issued a presidential ordinance abolishing the Fifth Schedule, which had previously capped petroleum levy rates at Rs 70 per litre. With the schedule removed, the government now has unrestricted authority to set levy rates at its discretion.

The Federation of Pakistan Chambers of Commerce and Industry’s Businessmen Panel (BMP) has expressed serious concern over the potential additional levies, including a significant hike in the petroleum levy. BMP Chairman and former FPCCI president Mian Anjum Nisar described these developments as deeply troubling for the already struggling business community, warning that such decisions could further damage the economy and investor confidence.

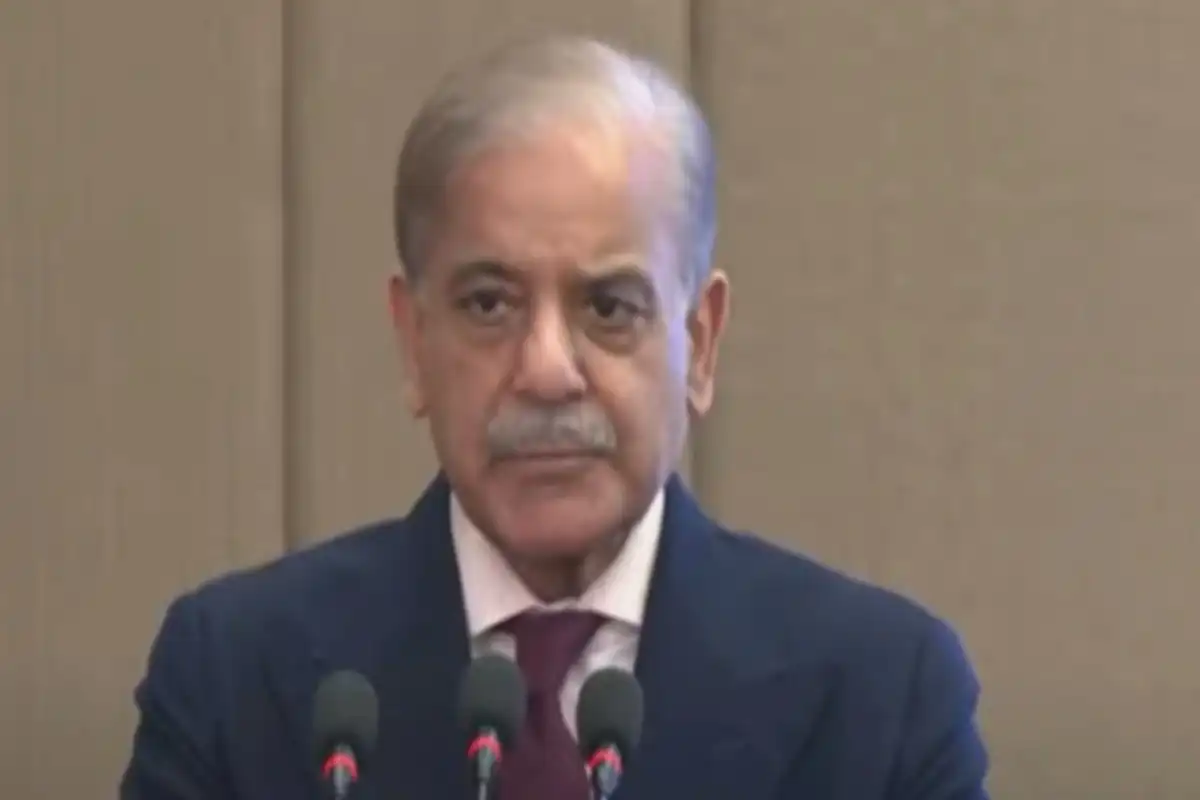

The government is committed to creating a conducive business environment, encouraging investment and increasing exports. With a clear vision of economic growth, supporting businesses and promoting exports, the government is introducing a comprehensive ‘tariff reform package’ aimed at making the current tariffs appropriate, so that economic growth can be accelerated by increasing exports.