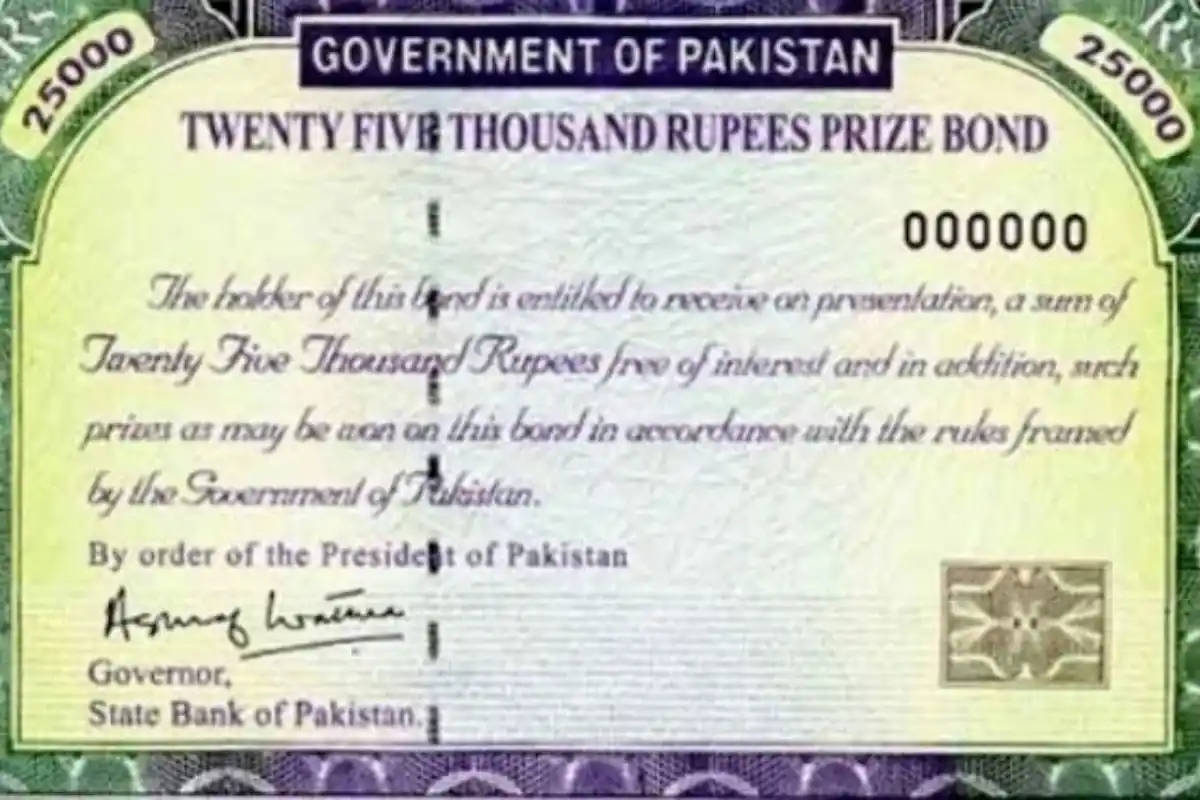

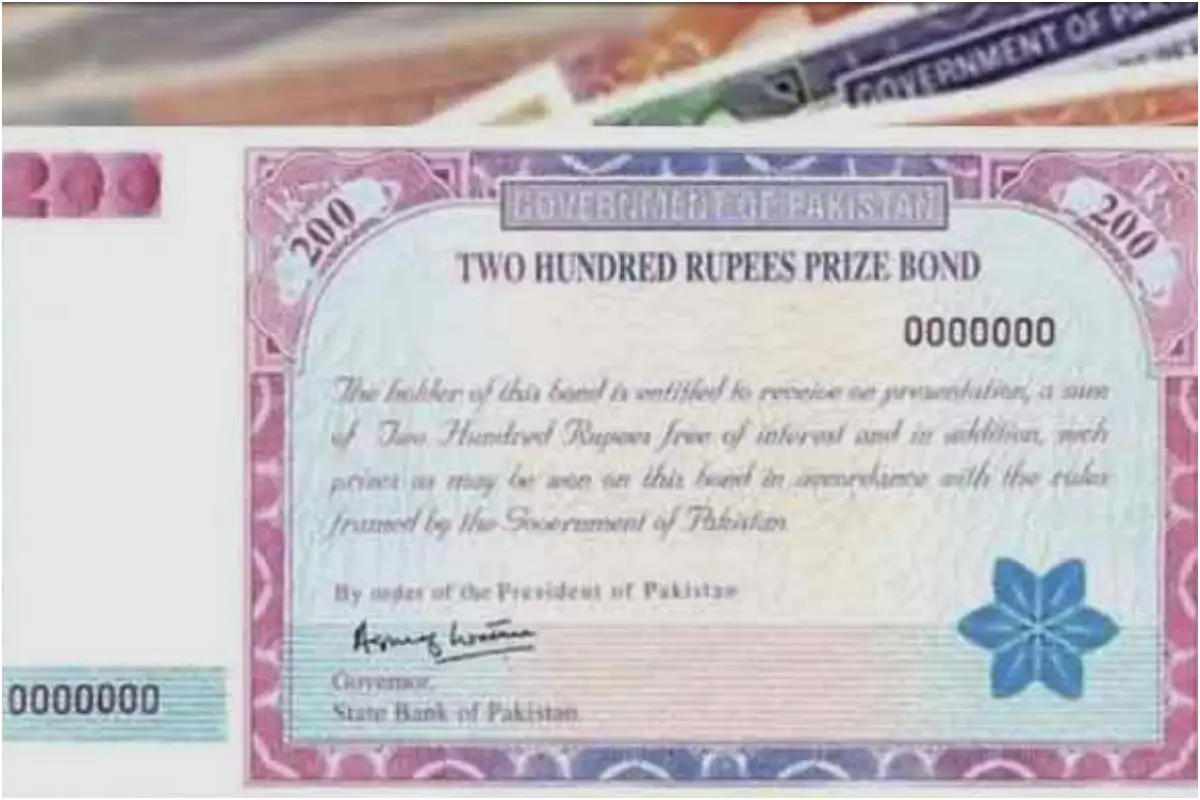

Tax on Prize Bonds: What You Need to Know in 2025

Tax on Prize Bonds: What You Need to Know in 2025

Catch all the Business News, Breaking News Event and Trending News Updates on GTV News

Join Our Whatsapp Channel GTV Whatsapp Official Channel to get the Daily News Update & Follow us on Google News.