Islamabad, January 2026 — Pakistan’s tax authority has introduced higher charges for people who do not file income tax returns, widening the financial gap between tax filers and non-filers.

The Federal Board of Revenue (FBR) says the move is meant to encourage more people to register with the tax system and improve compliance. The updated tax rates will remain in effect until June 2026.

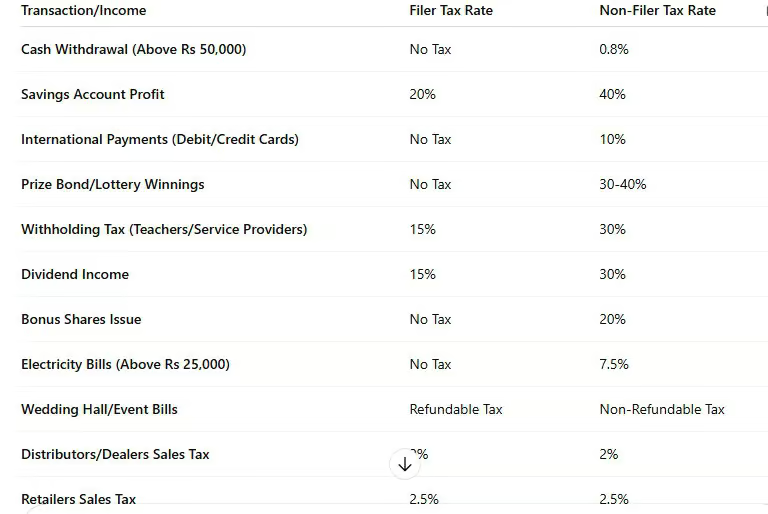

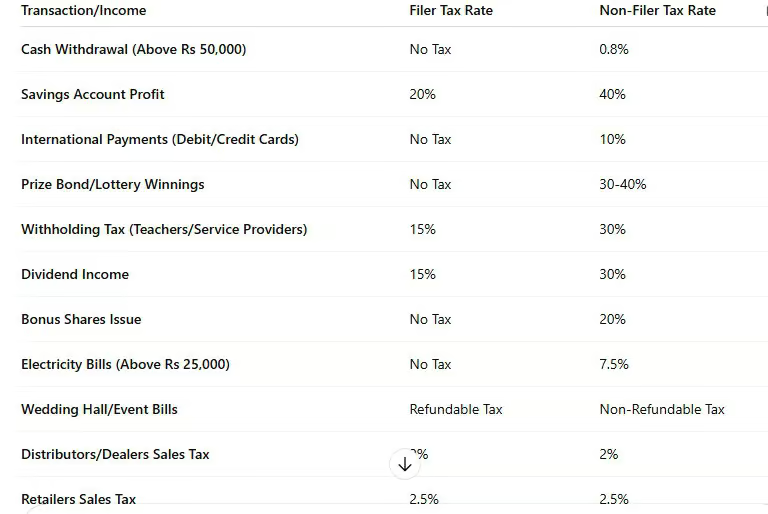

Under the new rules, non-filers will pay significantly higher taxes on a wide range of everyday financial transactions, including banking, investments and prize winnings.

Non-filers withdrawing more than Rs50,000 in cash from a bank in a single day will face a 0.8% tax. Filers are not subject to this charge.

Taxes on savings have also been increased for non-filers. They will pay up to 40% tax on profits earned from savings accounts, while filers will be charged 20%.

International payments made using debit or credit cards will now attract a 10% tax for non-filers. This applies to online purchases and foreign transactions.

Non-filers will also face higher deductions on prize bond and lottery winnings. The withholding tax in such cases ranges between 30% and 40%, while filers are taxed at lower rates.

Other sectors have also been affected. Non-filer teachers and service providers will be charged a 30% withholding tax. On dividend income, non-filers will pay 30%, compared to 15% for filers. A 20% tax will apply to bonus shares for non-filers.

Residential electricity consumers who are non-filers will pay a 7.5% tax on monthly bills exceeding Rs25,000.

The FBR has also clarified that taxes charged to non-filers on wedding halls and event services will be non-refundable. Filers, however, will be able to claim refunds where applicable.

For businesses, non-filers working as distributors will pay a 2% tax, while retailers will be charged 2.5%. The tax on service exports remains unchanged at 1% for both filers and non-filers.

Pakistan has long faced challenges in expanding its tax base. Officials say the latest measures are intended to discourage non-compliance and push more citizens into the formal tax system.