How salary tax calculation from FY2025 to FY2026 – check details

How salary tax calculation from FY2025 to FY2026 - check details

The federal government has announced a major cut in income tax for the salaried class, starting July 2025, under the budget for the new financial year 2025–26.

What’s the Good News?

People earning between Rs50,000 and Rs3 million per month will pay less tax. Monthly savings will range from Rs2,000 to over Rs16,000, depending on salary. This move is meant to help people deal with rising prices and inflation.

Relief for Low-Income Earners

If your salary is Rs100,000 per month, your tax will drop from Rs30,000 per year to Rs6,000 per year, saving you Rs2,000 each month.

People earning Rs150,000/month will now pay Rs6,000/month instead of Rs10,000, saving Rs4,000/month.

Middle-Income Savings

Those earning Rs300,000/month will pay Rs38,833/month in tax, down from Rs45,833.

If your income is Rs600,000/month, your tax will go down from Rs113,750 to Rs106,750—a monthly saving of Rs7,000.

High-Income Tax Cuts

A person earning Rs1 million/month will save Rs7,000/month in tax.

A top earner with Rs3 million/month salary will save Rs16,888/month.

Why Is This Happening?

The government says this tax cut will leave more money in people’s hands, helping them spend more, which can boost the economy. It’s also a way to support the middle class, who have been struggling with high costs and limited salary increases.

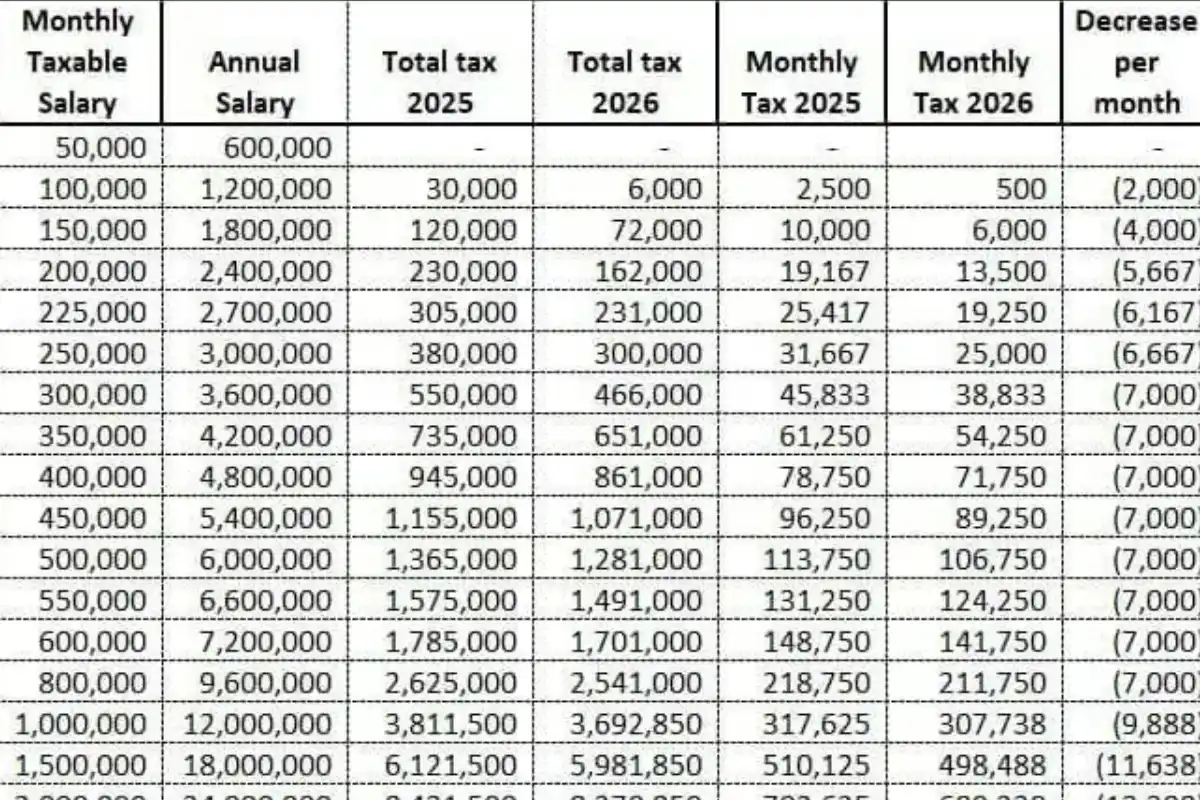

Check the Complete Tax Details Below

| Monthly Taxable Salary | Annual Salary | Total Tax 2025 | Total Tax 2026 | Monthly Tax 2025 | Monthly Tax 2026 | Decrease per Month |

|---|---|---|---|---|---|---|

| 50,000 | 600,000 | – | – | 2,500 | 500 | (2,000) |

| 100,000 | 1,200,000 | 30,000 | 6,000 | 2,500 | 500 | (2,000) |

| 150,000 | 1,800,000 | 120,000 | 72,000 | 10,000 | 6,000 | (4,000) |

| 200,000 | 2,400,000 | 230,000 | 162,000 | 19,167 | 13,500 | (5,667) |

| 225,000 | 2,700,000 | 305,000 | 231,000 | 25,417 | 19,250 | (6,167) |

| 250,000 | 3,000,000 | 380,000 | 300,000 | 31,667 | 25,000 | (6,667) |

| 300,000 | 3,600,000 | 550,000 | 466,000 | 45,833 | 38,833 | (7,000) |

| 350,000 | 4,200,000 | 735,000 | 651,000 | 61,250 | 54,250 | (7,000) |

| 400,000 | 4,800,000 | 942,000 | 861,000 | 78,750 | 71,750 | (7,000) |

| 450,000 | 5,400,000 | 1,155,000 | 1,071,000 | 96,250 | 89,250 | (7,000) |

| 500,000 | 6,000,000 | 1,365,000 | 1,281,000 | 113,750 | 106,750 | (7,000) |

| 550,000 | 6,600,000 | 1,575,000 | 1,491,000 | 131,250 | 124,250 | (7,000) |

| 600,000 | 7,200,000 | 1,785,000 | 1,701,000 | 148,750 | 141,750 | (7,000) |

| 800,000 | 9,600,000 | 2,625,000 | 2,541,000 | 218,750 | 211,750 | (7,000) |

| 1,000,000 | 12,000,000 | 3,465,000 | 3,381,000 | 288,750 | 281,750 | (7,000) |

| 1,500,000 | 18,000,000 | 5,961,000 | 5,881,850 | 496,750 | 490,154 | (6,596) |

| 2,000,000 | 24,000,000 | 8,431,500 | 8,270,850 | 702,625 | 689,238 | (13,388) |

| 2,500,000 | 30,000,000 | 10,247,500 | 10,041,850 | 853,958 | 836,821 | (17,137) |

| 3,000,000 | 36,000,000 | 13,051,500 | 12,848,850 | 1,087,625 | 1,070,738 | (16,888) |

Read More: How much tax will you pay for online shopping July 2025?

Catch all the Pakistan News, Breaking News Event and Trending News Updates on GTV News

Join Our Whatsapp Channel GTV Whatsapp Official Channel to get the Daily News Update & Follow us on Google News.