The Pakistan Telecommunication Authority (PTA) has signaled its support for easing the heavy tax burden on imported mobile phones, a move that could lead to noticeably lower handset prices across Pakistan in 2026.

Officials at the authority have acknowledged that the existing tax structure has placed modern smartphones beyond the reach of a large portion of the population. As a result, public dissatisfaction has continued to grow, particularly as mobile phones play an increasingly essential role in daily life.

According to reports, the PTA has formally shared its recommendations with the government, emphasizing that mobile phones can no longer be considered luxury items. Instead, they are now vital tools for education, business activities, digital banking, and online employment. The authority believes that steep import duties and taxes are limiting access to technology for ordinary users.

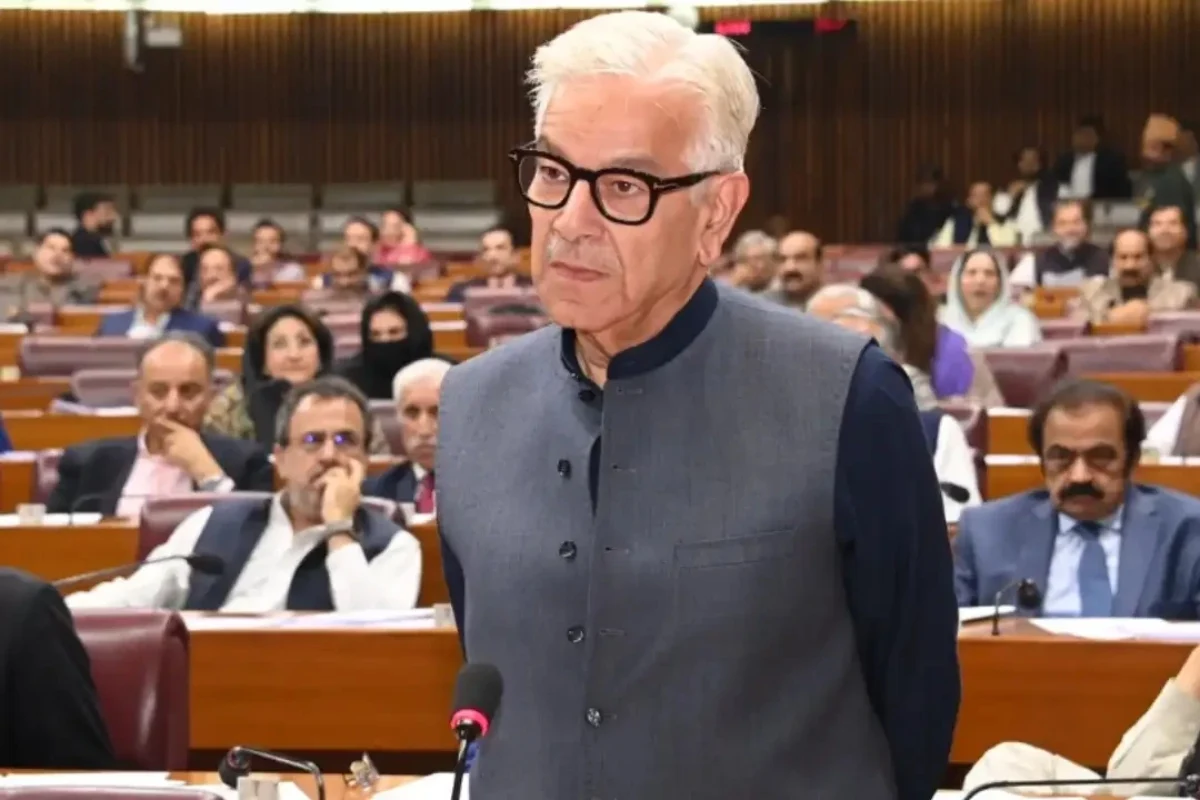

The PTA also highlighted concerns raised by overseas Pakistanis, who reportedly face high costs when registering personal mobile phones upon arrival in the country. These airport registration charges have triggered repeated complaints from expatriates returning home.

Officials noted that a balanced reduction in mobile phone taxes could ease the financial burden on consumers while encouraging the lawful import of devices. Experts agree that current prices in Pakistan are significantly higher than those in neighboring countries, a situation that has fueled smuggling and the circulation of illegally imported phones.

Analysts suggest that lowering taxes could increase market competition, reduce illegal trade, and potentially strengthen government revenue over time through higher volumes of legal sales.