Pakistan targets 4.2% economic growth in FY26 amid 7% spending Cut

Pakistan economic growth in FY26

Federal Finance Minister Muhammad Aurangzeb, while delivering the budget speech, said that it is an honor for me to present the budget before the esteemed house. This is the second budget of the coalition government. I thank the leadership of the coalition parties, Nawaz Sharif, Bilawal Bhutto, Khalid Maqbool, Chaudhry Shujaat, Abdul Aleem, Khalid Magsi, for their guidance.

Achieving a primary surplus equal to 2.4 percent of GDP, a significant reduction in inflation to 4.7 percent, it should be remembered that two years ago the inflation rate had reached 29.2 percent, a surplus current account is expected to be $1.5 billion compared to the deficit of $1.7 billion last year, the value of the rupee is stable, remittances increased by 31 percent in the 10 months of the current fiscal year to reach $31.2 billion.

We hope that by the end of the current fiscal year, the volume of remittances will reach 37 to 38 billion dollars. The State Bank’s foreign exchange reserves have increased by two billion dollars and will reach 14 billion dollars by the end of the current year. The government had to take tough decisions for economic improvement. The people also made many sacrifices, which yielded positive results.

Our most important economic problem was the persistent weakness of the revenue system. Pakistan’s tax-to-GDP ratio was 10.0 percent, which was insufficient to meet development expenditures and run the administrative affairs of the state. The FBR Transformation Plan was launched. The foundation of this plan is laid on People, Process and Technology.

Digital Transformation: For the first time in Pakistan, complete digital integration between the economy and the tax system has begun. Along with technology, steps are also being taken for human resources. Through data integration, 390,000 non-filers were identified, which made it possible to recover Rs. 300 million. Through fraud analyses, fake refund claims worth Rs. 9.8 billion were blocked. The number of fining and tax payers increased by 100 percent and revenue increased from Rs45 billion to Rs105 billion.

Many taxpayers try to evade taxes through lawsuits. Due to poor follow-up of these cases, government revenues remain subject to long delays. Due to the successful strategy of the current government, this year the FBR has collected revenues of Rs 78.4 billion through successful litigation. In addition, a case related to ADR was resolved through settlement in the courts, which earned the national treasury Rs 77 billion.

The copper and gold mines located in Reko Diq are an important asset for our future. The government is focused on making this asset useful. The feasibility study of this project was completed in January 2025. The expected mining period of this project is 37 years, during which the country will receive a cash flow of more than $75 billion.

Under this project, 41,500 jobs will be provided in construction work. The project is expected to generate $7 billion in taxes and $7.8 billion in royalties. This project will prove to be a game changer for Pakistan’s economy.

The following tariff reforms are being made part of the National Tariff Policy 2025-30.

Earlier, the federal cabinet approved the budget proposals for the fiscal year 2025-26 on Tuesday.

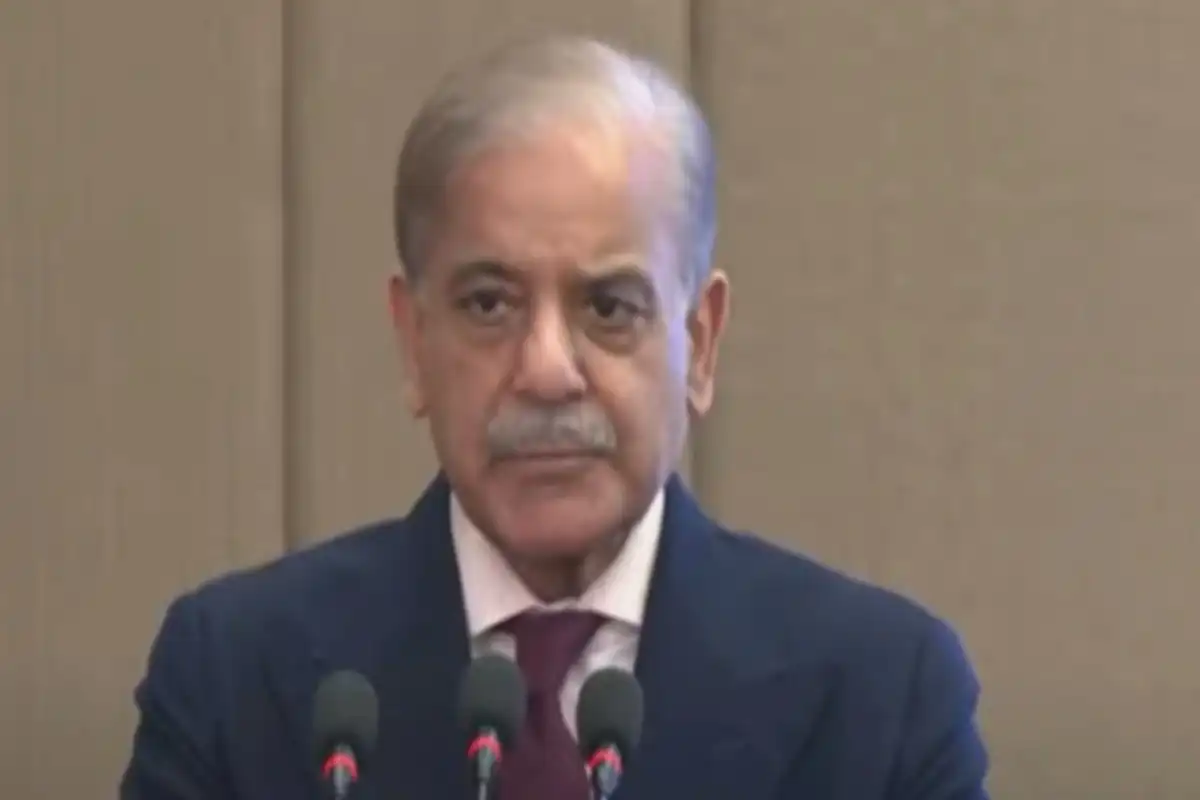

During a recent meeting led by Prime Minister Shehbaz Sharif, the economic team reached a consensus on a 6% salary hike for government employees.

This proposed increase, which emerged from initial discussions considering a 6% to 10% raise, now heads to the cabinet for its ultimate approval. It’s also anticipated that the government might consult with the Pakistan Peoples Party (PPP) regarding these budget proposals.

The National Assembly is set to convene today at 5 PM under the chairmanship of Speaker Sardar Ayaz Sadiq, where Finance Minister Muhammad Aurangzeb will present the federal budget of Rs 17,600 billion for the fiscal year 2025–26.

According to official sources, non-development expenditures will amount to Rs 16,286 billion, while the budget deficit is projected to be 5 percent of GDP, equating to Rs 6,501 billion. To address this, the government aims to collect Rs 14,131 billion in tax revenue and Rs 5,167 billion through non-tax revenue.

The total non-tax revenue target for the upcoming fiscal year has been set at Rs 19,298 billion. A significant policy shift includes a proposal to eliminate tax exemptions across all sectors. Additionally, the introduction of a 2.5 percent carbon levy is being considered as part of broader revenue-generation efforts.

Debt servicing remains a major expenditure, with Rs 8,207 billion proposed for interest payments. Defense allocations are expected to total Rs 2,550 billion. To boost petroleum-related revenue, the government has proposed increasing the petroleum levy from Rs 78 to Rs 100 per liter, with a goal of generating Rs 1,300 billion.

The federal development budget has been set at Rs 1,000 billion, including Rs 120 billion earmarked for the construction of the N-5 highway. Development funding for state-owned enterprises is projected at Rs 355 billion.

Provincial transfers will total Rs 8,206 billion, while provinces are expected to allocate Rs 3,300 billion for development projects. The budget also includes several measures aimed at providing relief to public sector employees. These include a proposed 10 percent salary increase for government employees and a 2.5 percent tax reduction across all salary slabs. Employees in grades 1 to 16 are expected to receive a 30 percent disparity allowance.

Pensioners may also see a 10 percent increase in their pensions, with Rs 1,055 billion allocated for this purpose. Meanwhile, subsidies amounting to Rs 1,186 billion are planned.

New tax measures are likely to impact digital earners, with proposals to bring YouTubers, freelancers, and non-filers under the tax net. The general sales tax (GST) on non-filers is expected to rise from 18 percent to 20 percent.

In a move to promote digital transactions, there will be no additional charges for purchasing petroleum products through digital payment methods. However, an additional Rs 2 per liter will be charged for fuel bought using cash.

Furthermore, the tax rate on cash withdrawals exceeding Rs 50,000 by non-filers is expected to double—from 0.6 percent to 1.2 percent. The budget also proposes Rs 971 billion for civil government expenditures during the next fiscal year.

Read More: Sindh Government to Present Fiscal Year Budget 2025-26 on June 13

Catch all the Pakistan News, Breaking News Event and Trending News Updates on GTV News

Join Our Whatsapp Channel GTV Whatsapp Official Channel to get the Daily News Update & Follow us on Google News.