The privatisation process of Pakistan International Airlines (PIA) officially entered its critical bidding phase on Tuesday, with three pre-qualified bidders submitting offers to acquire a majority stake in the country’s national flag carrier. This marks the second televised attempt to privatise PIA, after a failed auction last year.

The three bidders include a consortium led by Lucky Cement Limited, which includes Hub Power Holdings Limited, Kohat Cement Company Limited (KOHC), and Metro Ventures. The second bid comes from a consortium led by Arif Habib Corporation Limited, which includes Fatima Fertiliser Company Limited, City Schools, and Lake City Holdings Limited. The third bid comes from private airline Airblue (Private) Ltd.

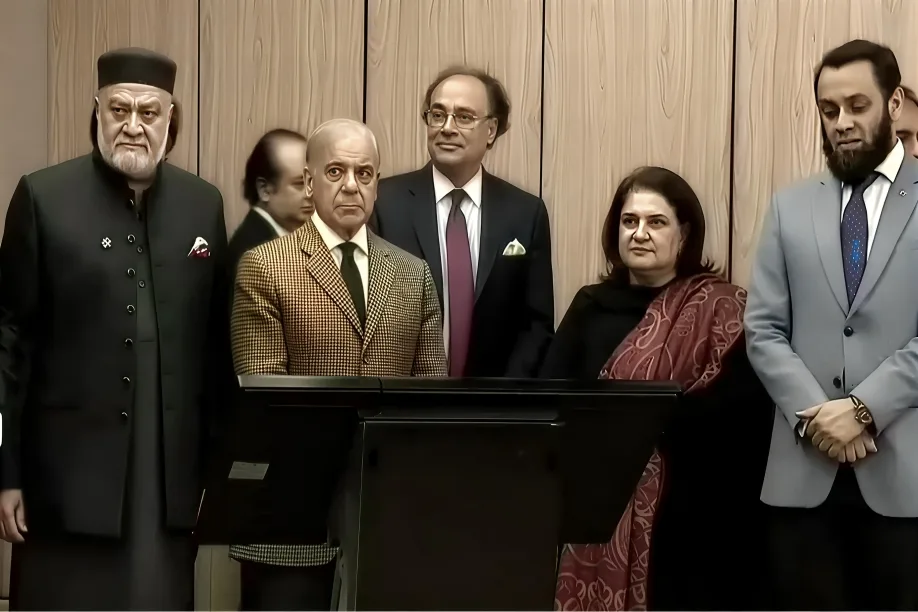

The auction ceremony was broadcast live on state television, with representatives of each bidding group walking in one by one to submit sealed bids into a transparent box. The bids will be opened in a ceremony starting at 3:30 pm in the presence of the bidders.

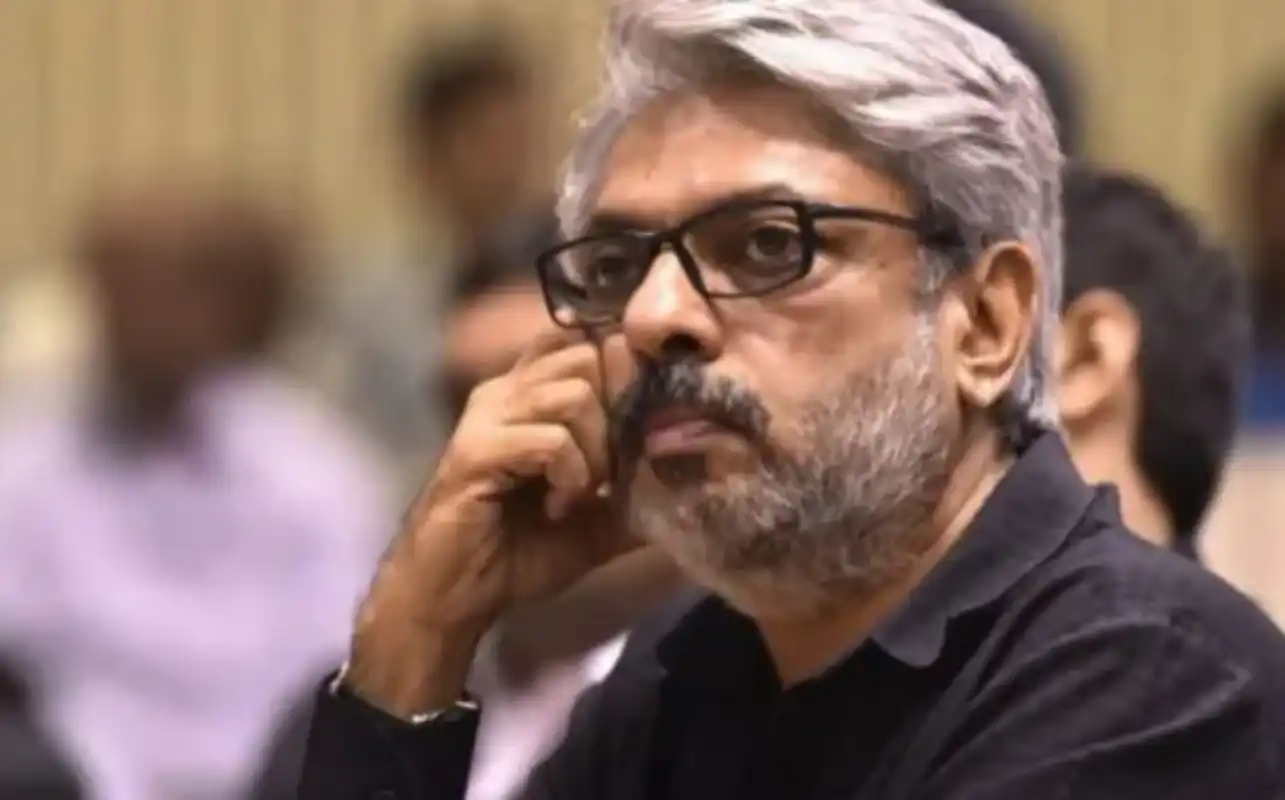

Prime Minister Shehbaz Sharif praised the transparency of the process, thanking the ministers and the Privatisation Commission for ensuring fairness. “I am thankful to the ministers and head of the Privatisation Commission for making the process transparent,” said Prime Minister Sharif, urging cabinet members to attend the second part of the auction ceremony.

The privatisation of PIA has become a significant step for the government under its broader privatisation agenda, which is part of the conditions set by Pakistan’s IMF bailout. This comes after last year’s failed attempt, where only a single bid was received from Blue World City, a real estate developer, but it fell far below the government’s $305 million minimum price. The bid from Blue World City, which was $36 million, was not increased, as the company cited concerns over the airline’s financial troubles and operational inefficiencies.

Fauji Fertiliser Company Ltd, which had been seen as a strong contender, withdrew from the bidding process last week, leaving only three active bidders. In the current privatisation plan, 92.5% of the amount received for the 75% stake will be reinvested directly into PIA, with the remaining 7.5% going to the government. The 25% stake that the government retains is seen as valuable, and bidders will have the option to acquire it later or leave it with the state.

Under the terms of the payment plan, the winning bidder must pay two-thirds of the bid amount within 90 days, with the remaining one-third due within 12 months. The government has also assured 12 months of job security for PIA employees, with pension liabilities, medical benefits, and other post-retirement perks to be handled by the new owner.

PIA has rights to 78 destinations and holds around 170 landing slots worldwide, making it an attractive asset. The airline’s financial health has improved since last year’s failed auction, with the government assuming a large portion of its legacy debt. PIA has posted its first pre-tax profit in two decades, and the airline is no longer under a EU and UK ban, allowing it to resume services on some of its most profitable routes.

The potential sale of PIA is part of a wider government initiative to privatise several state-owned enterprises, including banks, power distribution companies, and other loss-making entities, in an effort to curb the fiscal drain and restore investor confidence in the economy.

This step, while crucial for PIA’s revival, will also provide significant revenue to the government, with analysts hopeful that the airline’s reopened routes and improved financials will help secure a higher valuation this time around.