Popular News

Federal govt allocates Rs30bn to support bank lending to small businesses

Federal govt allocates Rs30bn to support bank lending to small businesses.

According to a press release on Wednesday, Ministry of Finance and State Bank of Pakistan have introduced risk-sharing mechanism.

Federal govt allocates Rs30bn

It aims at supporting bank lending to Small and Medium Enterprises and small businesses to avail SBP’s Refinance Facility to Support Employment.

The government has allocated this amount under a credit risk sharing facility for banks spread over four years to share the burden of losses due to any bad loans in future.

Under this risk sharing arrangement, Federal Government will bear 40 percent first loss on principal portion of disbursed loan portfolio of the banks.

This facility will incentivize banks to extend loans to collateral deficient SMEs and small corporates with sales turnover of upto two billion rupees to avail financing under SBP refinance scheme.

Under the SBP’s Refinance Scheme to Support Employment and Prevent Layoff of Workers due to the impact of COVID-19, businesses that commit to not lay off workers in the next three months can avail credit through banks for the three months of wages and salaries expenses at a concessional mark-up rate.

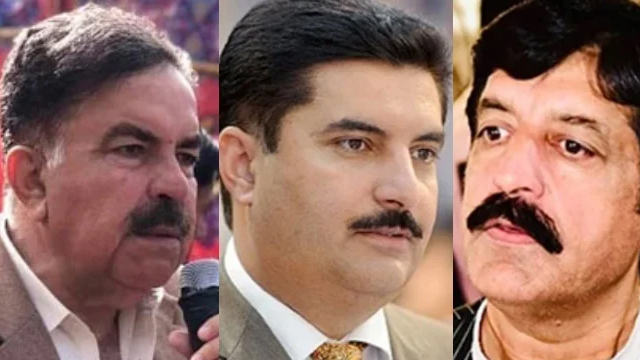

Meanwhile, Punjab Finance Minister, Hashim Jawan Bakht said government is emphasizing all the sectors for the revival of the corona-affected economic activities under a coordinated strategy.

He said this, while presiding over a meeting in Lahore.

The meeting reviewed the extension of small loans, SMEs and rural entrepreneurship under Punjab Post Corona Investment Programme.