Income tax calculator for FY 2025-26 – How does the new budget affect your salary

How salary tax calculation from FY2025 to FY2026 - check details

Finance Minister Muhammad Aurangzeb presented the budget for the fiscal year 2025–26 in the National Assembly. The budget comes at a time when Pakistan is working closely with the International Monetary Fund (IMF).

Monthly Income Tax Calculator 2025-2026

Calculate your monthly tax liability as per proposed Pakistan tax slabs

Your Tax Breakdown

Proposed Tax Slabs Comparison

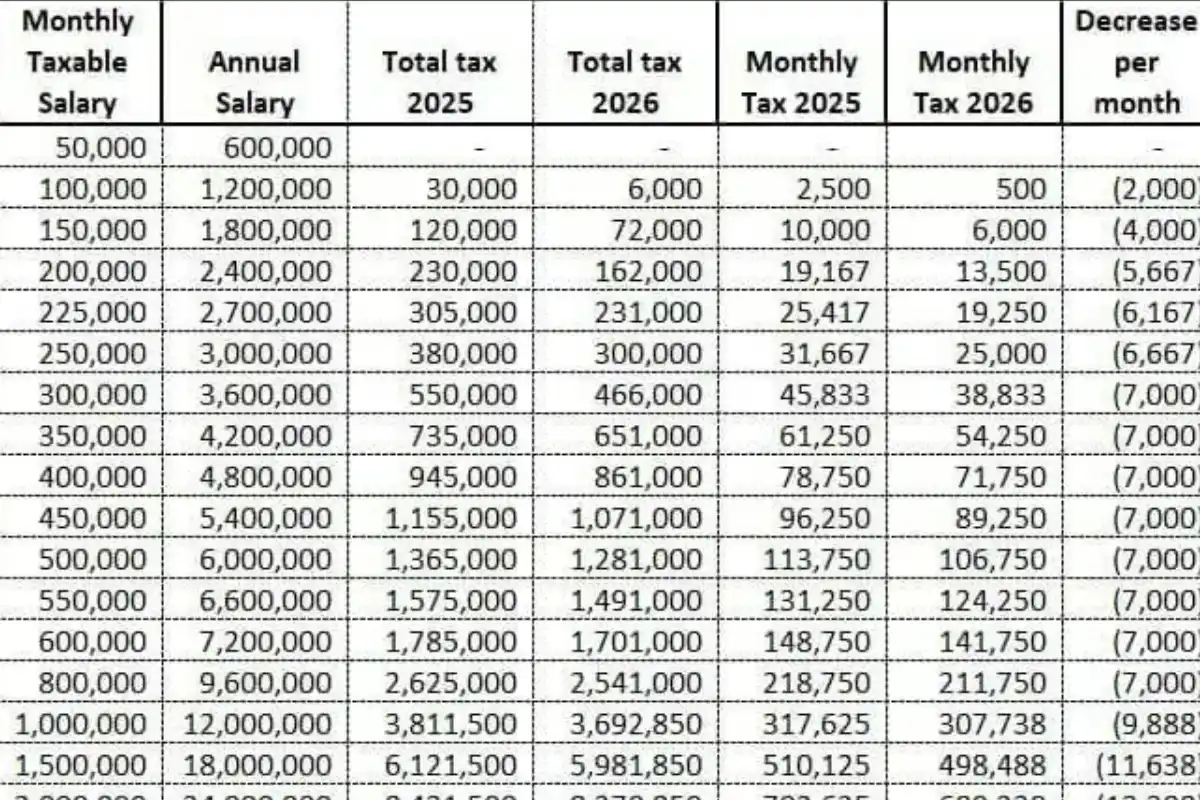

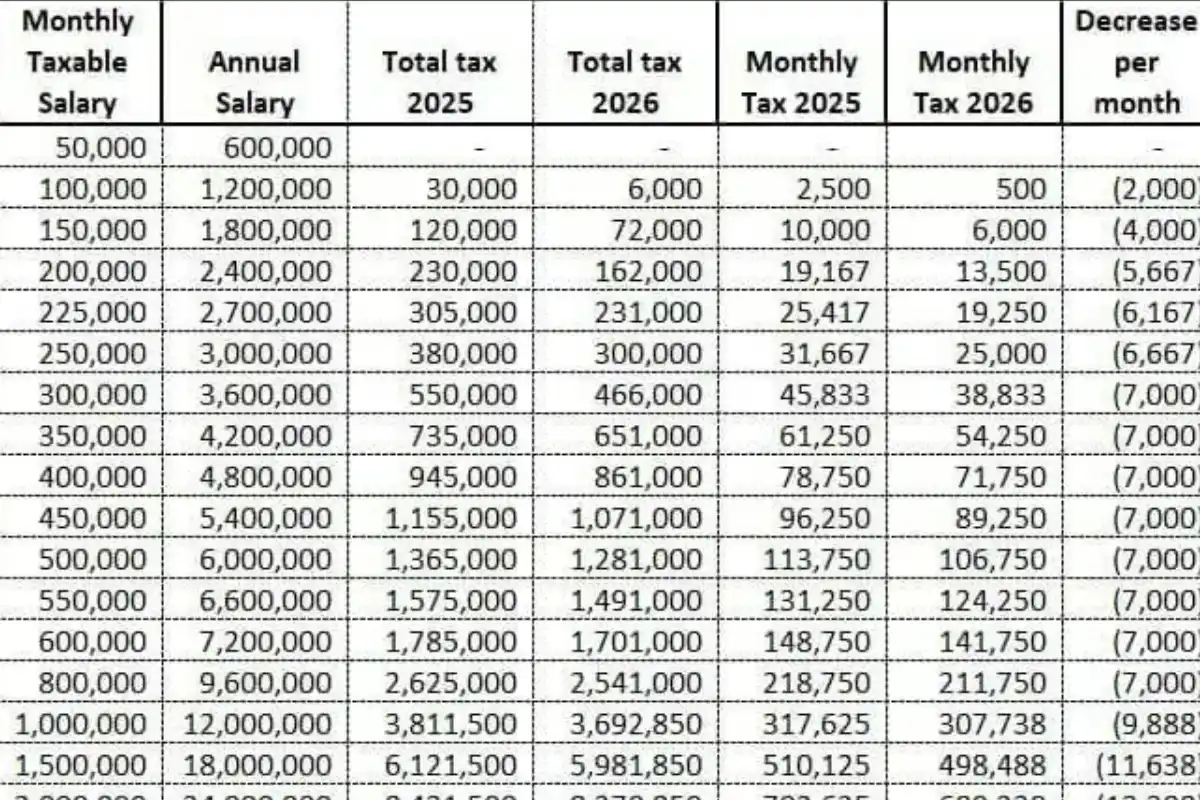

- 100,000/month: 2025: 2,500 | 2026: 500 | Savings: 2,000

- 150,000/month: 2025: 10,000 | 2026: 6,000 | Savings: 4,000

- 200,000/month: 2025: 19,167 | 2026: 13,500 | Savings: 5,667

- 250,000/month: 2025: 31,667 | 2026: 25,000 | Savings: 6,667

- 300,000/month: 2025: 45,833 | 2026: 38,833 | Savings: 7,000

- 400,000/month: 2025: 78,750 | 2026: 71,750 | Savings: 7,000

- 500,000/month: 2025: 113,750 | 2026: 106,750 | Savings: 7,000

- 1,000,000/month: 2025: 288,750 | 2026: 281,750 | Savings: 7,000

- 2,000,000/month: 2025: 702,625 | 2026: 689,238 | Savings: 13,388

- 3,000,000/month: 2025: 1,087,625 | 2026: 1,070,738 | Savings: 16,888

The government set a GDP growth target of 4.2%. It also aims to collect Rs14,131 billion in taxes, which is an 8.95% increase from last year’s goal.

Income Tax Cuts for Salaried Individuals

One of the most talked-about changes is the new income tax structure for salaried people. The updated policy reduces taxes for low-, middle-, and high-income earners. This move is designed to give financial relief to the public during tough economic times.

Here’s a breakdown of how much you’ll save under the new rates:

Income Tax Comparison (FY 2025 vs 2026)

PKR 50,000/month (PKR 600,000/year)

2025 Tax: No tax

2026 Tax: No tax

✅ No change

PKR 100,000/month (PKR 1.2 million/year)

2025 Tax: PKR 30,000/year

2026 Tax: PKR 6,000/year

💰 Saving: PKR 2,000/month

PKR 250,000/month (PKR 3 million/year)

2025 Tax: PKR 380,000/year

2026 Tax: PKR 300,000/year

💰 Saving: PKR 6,667/month

PKR 500,000/month (PKR 6 million/year)

2025 Tax: PKR 1,365,000/year

2026 Tax: PKR 1,281,000/year

💰 Saving: PKR 7,000/month

PKR 1 million/month (PKR 12 million/year)

2025 Tax: PKR 3,911,000/year

2026 Tax: PKR 3,692,850/year

💰 Saving: PKR 18,209/month

PKR 3 million/month (PKR 36 million/year)

2025 Tax: PKR 13,051,500/year

2026 Tax: PKR 12,848,850/year

💰 Saving: PKR 16,888/month

A Step Toward Relief

This tax reform reduces pressure on the middle class and salaried individuals. Monthly savings range between PKR 2,000 to over PKR 18,000, depending on salary. This means more disposable income for families dealing with high inflation.

The government says the move will ease financial stress, encourage consumer spending, and stimulate the economy.

Catch all the Trending News, Breaking News Event and Trending News Updates on GTV News

Join Our Whatsapp Channel GTV Whatsapp Official Channel to get the Daily News Update & Follow us on Google News.