Rs. 25,000 Prize Bond in Pakistan: November 2025 Update

Rs. 25,000 Prize Bond in Pakistan: November 2025 Update

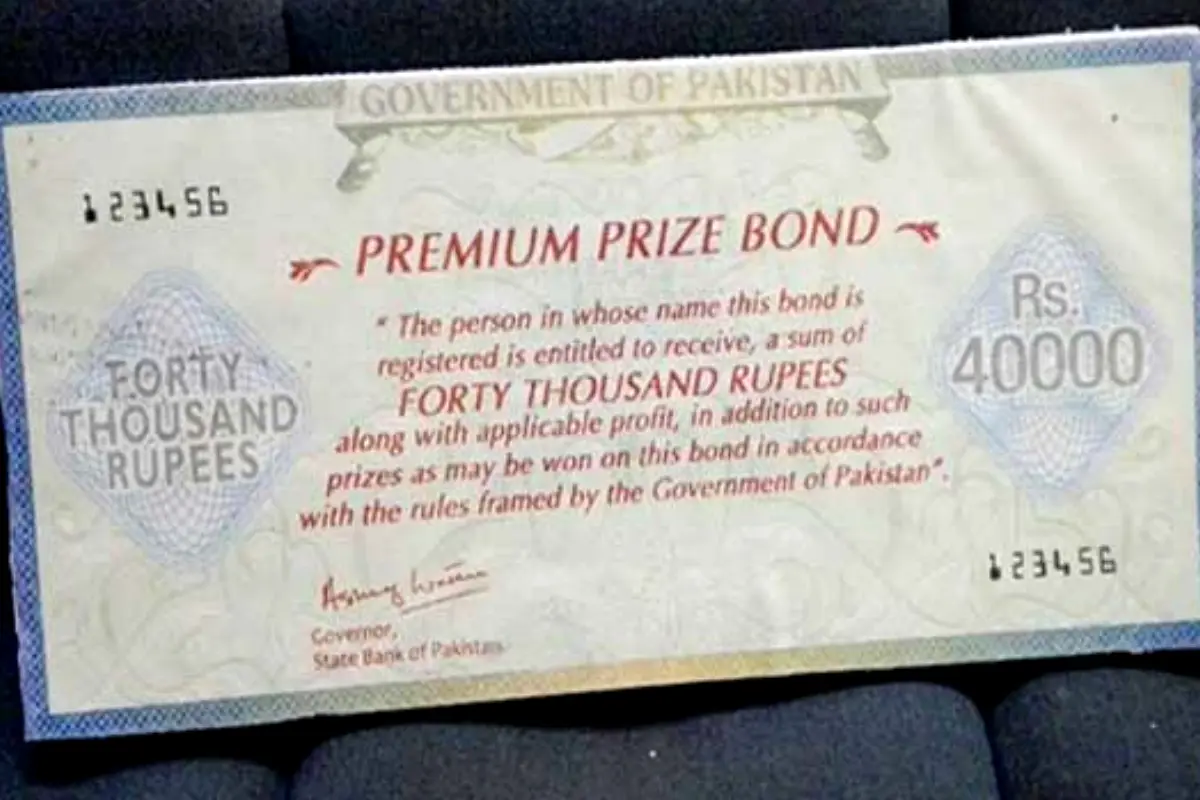

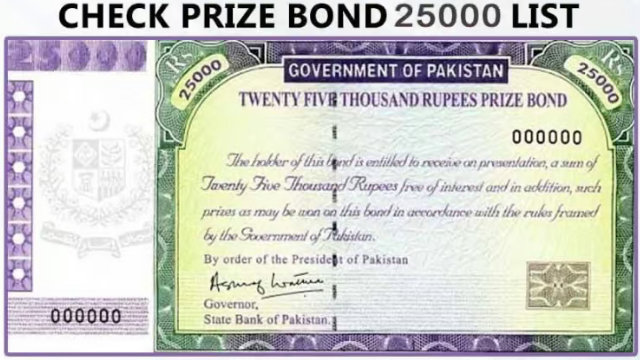

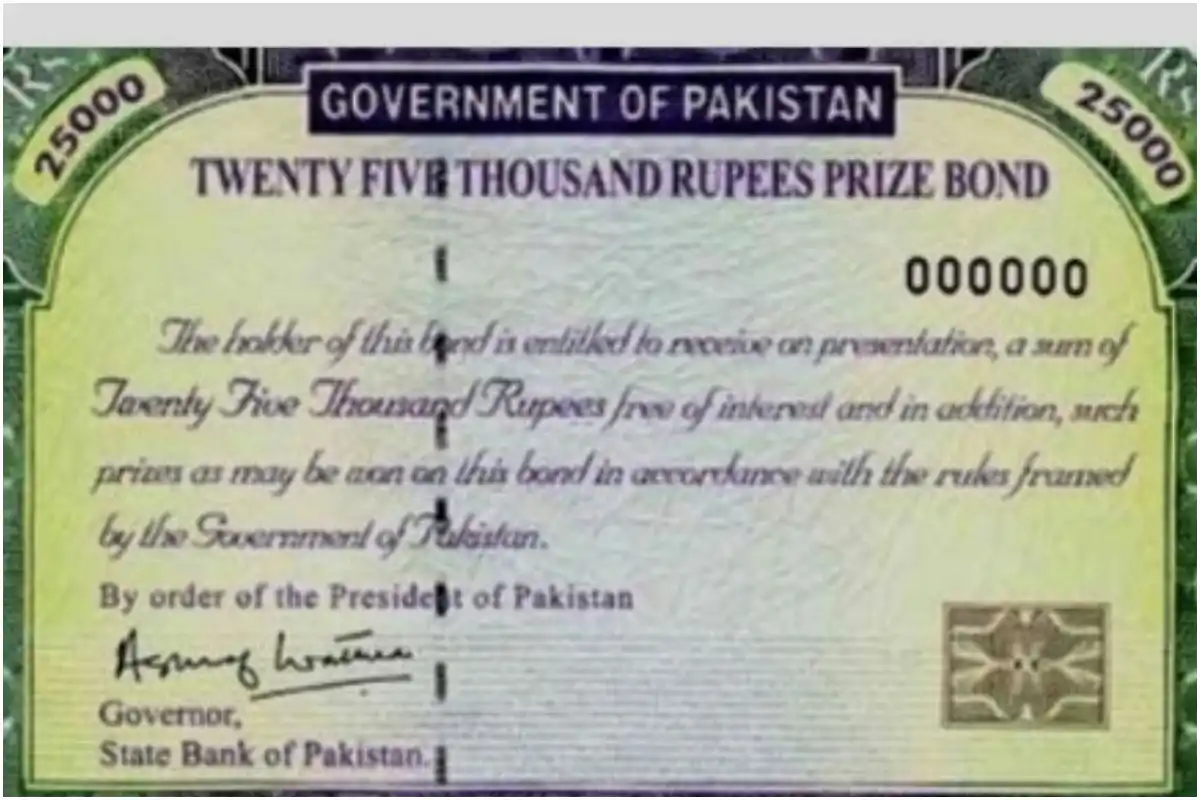

The Rs. 25,000 premium prize bond is one of the most prestigious financial products offered by the Government of Pakistan. Managed through the Central Directorate of National Savings (CDNS) and the State Bank of Pakistan (SBP), this bond offers a secure investment option with the added benefit of a chance to win substantial cash prizes. Unlike smaller denominations such as the Rs. 200 or Rs. 750 prize bonds, the Rs. 25,000 bond is a “registered” bond, meaning it is issued in the bondholder’s name, providing additional safety and security. The primary feature of a premium prize bond is that it is registered in the owner’s name, making it safer compared to normal bearer bonds. If the bond is lost, it cannot be claimed by anyone else. Additionally, premium bonds provide a return on investment, meaning bondholders earn a small profit even if they don’t win the prize draw. This makes the Rs. 25,000 bond an attractive option for investors looking for a secure way to grow their money. Launched as a more secure and profitable investment option, the Rs. 25,000 premium prize bond allows individuals to take part in a prize draw with significant cash rewards. The draws for the Rs. 25,000 bond are held four times a year, giving participants multiple chances to win. The prize structure for each draw includes: These draws take place in major cities across Pakistan, including Lahore, Karachi, Rawalpindi, and Peshawar. Bonds can be purchased from National Savings Centers, State Bank offices, or authorized bank branches. There are several reasons why the Rs. 25,000 premium bond is highly popular: Purchasing a Rs. 25,000 premium prize bond is straightforward: Once the draw takes place, the results can be checked through: Local newspapers and official notices To claim a prize, winners need to present the original bond, their CNIC, and a completed claim form at the State Bank of Pakistan. It is important to note that taxes will be deducted from the prize — 15% for tax filers and 30% for non-filers. Before investing in the Rs. 25,000 premium bond, keep the following points in mind: For individuals with some extra money to invest, the Rs. 25,000 premium prize bond offers a secure and profitable option. It is particularly suitable for professionals, business owners, and those looking for both guaranteed returns and a chance to win large prizes. However, because of its higher cost, it may not be ideal for those seeking smaller investments. In such cases, smaller denominations like the Rs. 750 or Rs. 1,500 bonds may be more appropriate. The Rs. 25,000 premium prize bond stands out as a solid choice for anyone looking to combine safety, profitability, and the thrill of winning a major prize.What Makes the Rs. 25,000 Prize Bond Unique?

Prize Structure and Draw Frequency

Why Investors Prefer the Rs. 25,000 Premium Bond

How to Buy the Rs. 25,000 Premium Prize Bond

Checking the Results and Claiming Prizes

Key Considerations

Is the Rs. 25,000 Bond a Good Investment?

Catch all the Prize Bond 2025 News, Breaking News Event and Trending News Updates on GTV News

Join Our Whatsapp Channel GTV Whatsapp Official Channel to get the Daily News Update & Follow us on Google News.